Reinforce Your Legacy With Specialist Depend On Structure Solutions

Professional depend on structure services offer a robust framework that can protect your assets and ensure your dreams are carried out exactly as planned. As we delve right into the nuances of trust fund structure remedies, we reveal the key aspects that can strengthen your legacy and supply a lasting effect for generations to come.

Advantages of Trust Fund Structure Solutions

Count on structure options supply a robust structure for securing properties and guaranteeing lasting monetary safety and security for people and companies alike. One of the main advantages of trust foundation remedies is asset security.

With depends on, people can lay out just how their properties should be managed and distributed upon their passing away. Trust funds also offer personal privacy advantages, as assets held within a count on are not subject to probate, which is a public and typically extensive lawful procedure.

Kinds of Trust Funds for Heritage Preparation

When considering tradition preparation, a vital facet entails exploring various kinds of lawful tools created to protect and disperse properties effectively. One usual kind of trust made use of in legacy planning is a revocable living trust. This count on allows individuals to preserve control over their possessions during their life time while making certain a smooth transition of these possessions to beneficiaries upon their passing away, preventing the probate process and giving personal privacy to the household.

Another kind is an irrevocable trust, which can not be modified or revoked as soon as established. This trust uses potential tax obligation benefits and shields assets from financial institutions. Charitable trust funds are likewise popular for individuals wanting to sustain a cause while keeping a stream of earnings on their own or their beneficiaries. Special requirements counts on are important for people with specials needs to ensure they get necessary treatment and assistance without endangering federal government benefits.

Comprehending the different sorts of trust funds readily available for heritage planning is critical in establishing a comprehensive strategy that lines up with private objectives and priorities.

Choosing the Right Trustee

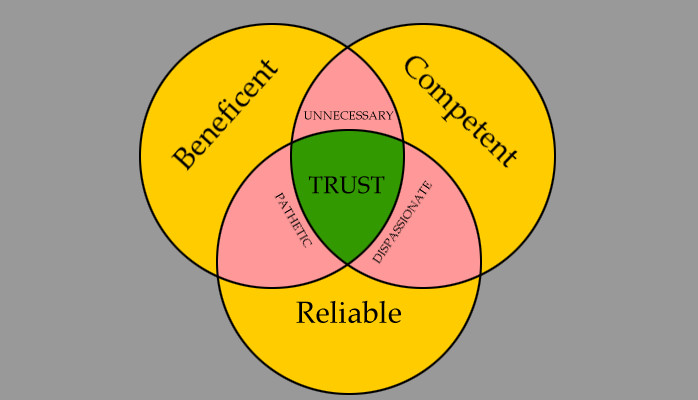

In the realm of heritage preparation, a crucial aspect that requires mindful factor to consider is the selection of a suitable individual to satisfy the critical role of trustee. Choosing the appropriate trustee go now is a decision that can substantially influence the successful implementation of a depend on and the satisfaction of the grantor's desires. When choosing a trustee, it is vital to prioritize top qualities such as trustworthiness, monetary acumen, integrity, and a commitment to acting in the very best rate of interests of the beneficiaries.

Preferably, the chosen trustee must have a solid understanding of monetary issues, be capable of making sound financial investment decisions, and have the capacity to browse complex legal and tax needs. By carefully considering these elements and selecting a trustee who lines up with the worths and objectives of the count on, you can assist ensure the long-lasting success and preservation of your legacy.

Tax Effects and Benefits

Thinking about the financial landscape surrounding depend on frameworks and estate preparation, it is vital to explore the complex realm of tax obligation implications and benefits - trust foundations. When Discover More developing a trust fund, comprehending the tax obligation effects is vital for maximizing the benefits and lessening possible liabilities. Counts on offer various tax obligation advantages relying on their structure and function, such as minimizing estate tax obligations, revenue tax obligations, and present taxes

One significant benefit of particular trust frameworks is the capacity to move assets to recipients with reduced tax obligation consequences. As an example, irrevocable trust funds can get rid of possessions from the grantor's estate, potentially reducing inheritance tax liability. In addition, some depends on enable earnings to be dispersed to recipients, that might be in reduced tax obligation braces, resulting in total tax obligation financial savings for my link the household.

However, it is essential to keep in mind that tax obligation regulations are complicated and subject to alter, emphasizing the need of seeking advice from with tax obligation specialists and estate preparation experts to guarantee compliance and make the most of the tax benefits of trust fund foundations. Correctly browsing the tax obligation ramifications of counts on can lead to substantial financial savings and a more reliable transfer of wealth to future generations.

Steps to Establishing a Trust Fund

The first action in establishing a trust is to clearly define the objective of the trust and the assets that will be consisted of. Next off, it is important to choose the type of trust fund that ideal aligns with your goals, whether it be a revocable trust, irreversible depend on, or living depend on.

Verdict

To conclude, developing a depend on foundation can provide numerous advantages for legacy planning, including asset security, control over distribution, and tax advantages. By picking the proper type of depend on and trustee, individuals can safeguard their possessions and guarantee their desires are performed according to their wishes. Comprehending the tax obligation implications and taking the essential steps to establish a trust fund can help reinforce your heritage for future generations.